Blockchain technology continues to revolutionize industries, emphasizing the need for secure and trustworthy transactions. Proxy accounts and multi-signature (multisig) accounts play pivotal roles in enhancing security and control over assets in the blockchain space. These mechanisms are crucial for both newcomers and experienced participants navigating decentralized systems.

Multi-signature accounts require multiple signatures to authorize a transaction, significantly enhancing security compared to single-signature accounts. For instance, a 2-of-3 multisig account necessitates two out of three designated signers to approve a transaction. This feature not only reduces the risk of unauthorized transactions but also adds an additional layer of security.

The 2016 Bitfinex hack exemplifies the importance of multisig accounts. The exchange lost $72 million worth of Bitcoin, but the use of multisig accounts limited the impact, as not all funds were stored in a multisig account. This incident underscores the significance of implementing multisig accounts to mitigate the risk of large-scale theft.

Conversely, the Parity wallet bug in Ethereum resulted in the loss of millions of dollars’ worth of Ether due to a vulnerability in the multisig wallet contract. This incident highlights the critical need for comprehensive security audits and robust smart contract development in implementing multisig accounts.

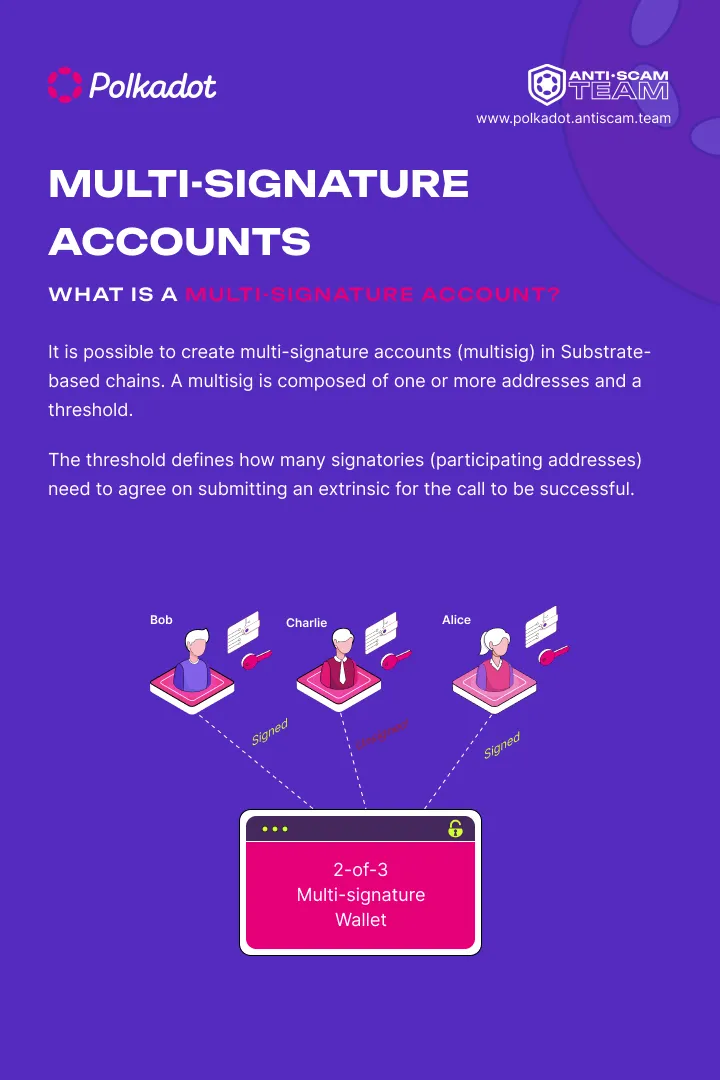

It is possible to create multi-signature accounts (multisig) in Substrate-based chains, offering a powerful tool for enhancing security and governance. A multisig is composed of one or more addresses and a threshold, which defines how many signatories (participating addresses) need to agree on submitting an extrinsic for the call to be successful. In Polkadot’s ecosystem, there are multiple multisig apps that facilitate these types of transactions, so that individuals, groups of people, or even enterprises can leverage these types of accounts by creating, managing, and executing said types of transactions.

Multisig accounts are also used for board decisions in legal entities like businesses and foundations, where collective governance over the entity’s treasury is necessary. Additionally, multisig accounts can be used for group participation in governance, such as in Polkadot’s governance, where a set of community members could vote as one entity.

Proxy accounts empower one user (the proxy) to perform actions on behalf of another user (the principal). Proxies can be delegated specific powers, such as voting or executing transactions, without transferring ownership of assets. This feature enhances flexibility and control over assets.

Proxy accounts have been instrumental in decentralized finance (DeFi) governance models. In the MakerDAO ecosystem, token holders can delegate their voting power to proxies who vote on their behalf. This approach has significantly increased efficiency and participation in the governance process.

However, there have been instances where proxies were compromised, leading to unauthorized transactions or misuse of delegated powers. For example, reports of vote buying and manipulation through proxies on the EOS blockchain have raised concerns about the integrity of the governance process.

Having a staking proxy isolates the stash account within the staking context, allowing the proxy account to participate in staking on behalf of the stash. Without a proxy, all staking-related transactions would need to be signed with the stash, increasing the risk. If a proxy is compromised, it doesn’t have access to transfer-related transactions, so the stash account can set a new proxy to replace it. Additionally, creating multiple proxy accounts that act for a single account allows for more granular security practices around protecting private keys while actively participating in the network. Polkadot allows up to 32 proxies for a single account, and the same proxy can be used for multiple accounts.

Polkadot for example offers various types of proxies, such as Any, Non-transfer, Governance, Nomination pool, Staking, Identity Judgement, Cancel, and Auction, each with specific permissions for different types of transactions. Proxies require deposits in the native currency to be created, with the deposit amount determined by a formula that includes a base deposit and a factor based on the number of proxies. Time-delayed proxies add an additional layer of security by requiring a delay time, which can be quantified in blocks. This delay allows the proxy’s intended action to be canceled within the delay period, providing an opportunity to prevent unauthorized transactions.

Both proxy and multisig accounts play a crucial role in managing risk in blockchain transactions. Multisig accounts reduce the risk of unauthorized transactions, while proxy accounts provide oversight and control over delegated actions.

Conclusion

Proxy and multi-signature accounts are indispensable tools in the blockchain space, offering enhanced security and control over assets. Understanding how these mechanisms work and how they can be used to manage risk is crucial for navigating the blockchain landscape with confidence and security. Whether you’re a novice or a seasoned participant, integrating proxy and multi-signature accounts into your strategy can help you protect and manage your assets more effectively.