ArthSwap, a decentralized exchange (DEX) operating on the Astar Network within the Polkadot ecosystem, emerges as a pivotal player in the decentralized finance (DeFi) landscape. Positioned as the principal DEX on Astar, ArthSwap provides an array of services, including fast and cost-effective trading, staking, and yield farming. Its focus on interoperability and scalability aims to make DeFi more accessible, especially for users interested in cross-chain asset interactions. However, as with any emerging DeFi platform, ArthSwap’s growth comes with both promising potential and notable challenges.

Core Features and Value Proposition

ArthSwap capitalizes on Astar Network’s high-performance infrastructure to offer a seamless DeFi experience. The platform’s business model is primarily centered on trading fees and staking rewards. A 0.3% transaction fee structure—0.25% allocated to liquidity providers and 0.05% to stakers—ensures incentivized participation. Additionally, its high annual percentage yield (APY) for liquidity farming and staking appeals to users seeking significant returns. The inclusion of an Initial DEX Offering (IDO) launchpad enhances its utility, solidifying ArthSwap’s position as an integral part of the Astar ecosystem.

Strengths and Ecosystem Integration

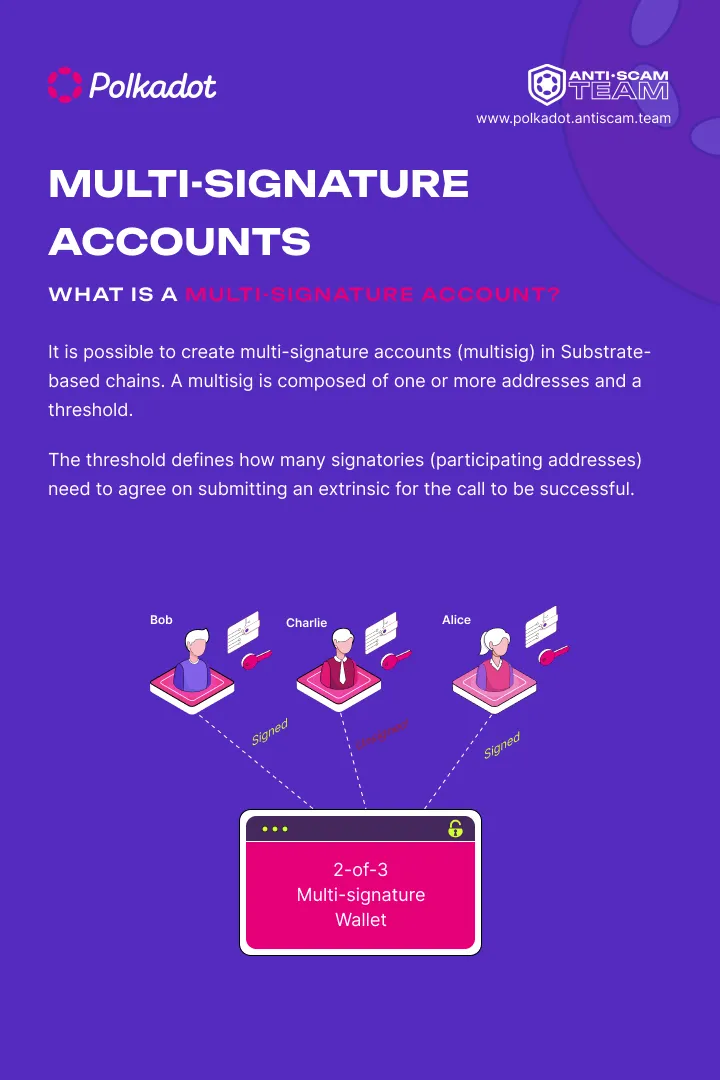

- Scalability and Interoperability: Built on Astar Network, ArthSwap benefits from Polkadot’s relay chain, which supports cross-chain interactions and seamless data sharing between blockchains.

- Comprehensive Offerings: Beyond trading and staking, the platform supports liquidity farming and IDO services, diversifying its appeal.

- Support from Key Investors: ArthSwap’s backing by Astar, Next Web Capital, and Hypersphere Ventures strengthens its ecosystem relevance.

- Security Measures: Audits conducted by Quantstamp and PeckShield in 2022 confirmed that almost all vulnerabilities had been resolved, enhancing trust among users.

Challenges and Risks

- Transparency Concerns: Despite being led by Daisuke Yamada as CEO, the limited publicly available information about the ArthSwap team raises concerns regarding accountability and expertise. A lack of verifiable professional history creates uncertainty, especially in a sector where trust is paramount.

- Community Engagement Issues: ArthSwap boasts a large follower base on platforms like X (formerly Twitter) and Discord, but engagement metrics suggest low interaction. Minimal updates and inconsistent communication further challenge the platform’s ability to foster an active and vibrant community.

- Stagnant Development: Although the project’s GitHub repositories are open-source and follow standard practices, activity levels are low, with few updates in recent years. This lack of ongoing development could hinder future growth and innovation.

Tokenomics and Sustainability

The ARSW token plays a central role in ArthSwap’s ecosystem, enabling staking rewards and liquidity incentives. While the platform’s tokenomics are designed to drive early adoption, the significant allocation to liquidity mining (35%) raises questions about long-term sustainability. Maintaining user interest after initial reward periods requires introducing real utility for the ARSW token, which remains an area for improvement.

Conclusion and Outlook

ArthSwap showcases significant potential as a DeFi protocol on the Astar Network, leveraging its strategic ecosystem alignment and attractive financial incentives. However, to secure a leadership position in the competitive DeFi market, it must address critical challenges related to team transparency, community engagement, and development consistency. Investors and users are advised to exercise caution, conducting thorough due diligence while monitoring the platform’s progress in addressing these areas.

With its current trajectory, ArthSwap’s ability to innovate and enhance user trust will determine its viability and long-term success within the Polkadot ecosystem.